Why I Still Own Disney Stock

(Photo Credit: Courtnie Lewis)

I've been a stockholder of Disney since birth, No, I'm not joking. My grandparents bought it for me as a gift the day I was born. The stock has increased ~10.2x since that year, 1994. No doubt, a solid return. In that same period, the Dow Jones has returned ~6.84x. Not too shabby of a choice by my grandparents when you look at the Dow Jones.

But what about the Nasdaq?

Well that's a different story. The NASDAQ has returned ~14.9x in the same time frame. The trend is tech stocks (most of which is in the NASDAQ) that outperformed non-tech stocks over the past 26 years.

The first 11 years of ownership were iffy at best. Then in 2005, Bob Iger, Disney's COO and president, was named CEO. Disney lost touch with its roots. It went from iconic brand to bureaucracy led by its dictator CEO, Michael Eisner. One of the most memorable failures was Disney Stores. A retail effort that cost the company $100MM+. Mr. Iger changed that.

The Bob Iger Era

Bob Iger would bring Disney back to the Disney of old. The one that Walt Disney, founder of Disney, pioneered—centered around its famed animation studio.

(Photo Credit: Jason Kottke)

Roy Disney, nephew of Walt Disney, wrote upon the appointment of Mr. Iger:

"Animation has always been the heart and soul of The Walt Disney Company, and it is wonderful to see Bob Iger and the company embrace that heritage by bringing the outstanding animation talent of the Pixar team back into the fold. This clearly solidifies The Walt Disney Company's position as the dominant leader in motion picture animation and we applaud and support Bob Iger's vision."

Bob Iger worked fast. In his first year, he bought Pixar for $7.4B. The acquisition brought along Steve Jobs, founder of Pixar, as a Disney board member. He also ended up becoming Disney's largest shareholder.

During his 15 years as CEO, Bob Iger transformed Disney through acquisitions: Marvel, Lucasfilm, creators of Star Wars, and 21st Century Fox

He brought Disney back to its roots—helping introduce the next generation to a new set of Disney characters: Walle-E, Elsa and Lightning McQueen.

These acquisitions and newly acquired fans helped Disney make a lot of money. In 2019, Disney produced seven of the top ten grossing films—yielding more than $10B in ticket sales.

More importantly, he leveraged the success of the brands. He started with the parks. He built a Frozen-themed ride at Epcot. He revamped it's a Small World, to include more modern characters such as Moana.

He built a licensing empire. In 2018, Disney was the top licensor in the world. It earned $54.7B in retail sales on licensed merchandise. This isn’t easy. Netflix generates little revenue on licensing. It's attempt to create Stranger Things merchandise failed miserably.

Content is the Fuel That Powers the Machine

As Walt Disney's flywheel predicted more than 50 years ago, its content was the fuel that powered the machine. A machine with $69.57B in revenue in 2019 from four business segments:

Media Networks

Parks Experiences and Products

Studio Entertainment

Direct to Consumer and International

But his most important contribution to the company came at the end of his tenure—launching Disney+. Bob Iger, didn't say it at the time, but he knew Disney needed to adopt. Disney's old model was reliant on others for distributions. It's content, both old and new needed consumers. It was mediums such as Netflix or movie theatres that brought the consumers. In the long run, this content not only cost Disney money, but cost them control of their audience.

On November 8th, 2018, Disney+ was announced. This would be the distribution that Disney needed. It would own its content and its audience.

On November 12th, 2019 Disney+ launched. The first day it had 10M subscribers. A year later, Disney+ now has 73.7M subscribers. It predicted 60M - 90M subscribers by 2024—blowing away its own projections.

Bob Chapek, CEO of Disney, agreed with the future that Bob Iger laid out. He saw the success of Disney+ and knew the world was changing. If the last decade was about building the audience, the next decade would be about retaining the audience. At the core of that would be DTC (direct to consumer). Disney wrote in a statement to shareholders on October 12th, 2020:

"In light of the tremendous success achieved to date in the Company’s direct-to-consumer business and to further accelerate its DTC strategy, The Walt Disney Company (NYSE: DIS) today announced a strategic reorganization of its media and entertainment businesses. Under the new structure, Disney’s world-class creative engines will focus on developing and producing original content for the Company’s streaming services, as well as for legacy platforms, while distribution and commercialization activities will be centralized into a single, global Media and Entertainment Distribution organization. The new Media and Entertainment Distribution group will be responsible for all monetization of content—both distribution and ad sales—and will oversee operations of the Company’s streaming services. It will also have sole P&L accountability for Disney’s media and entertainment businesses."

Mulan As a Barometer

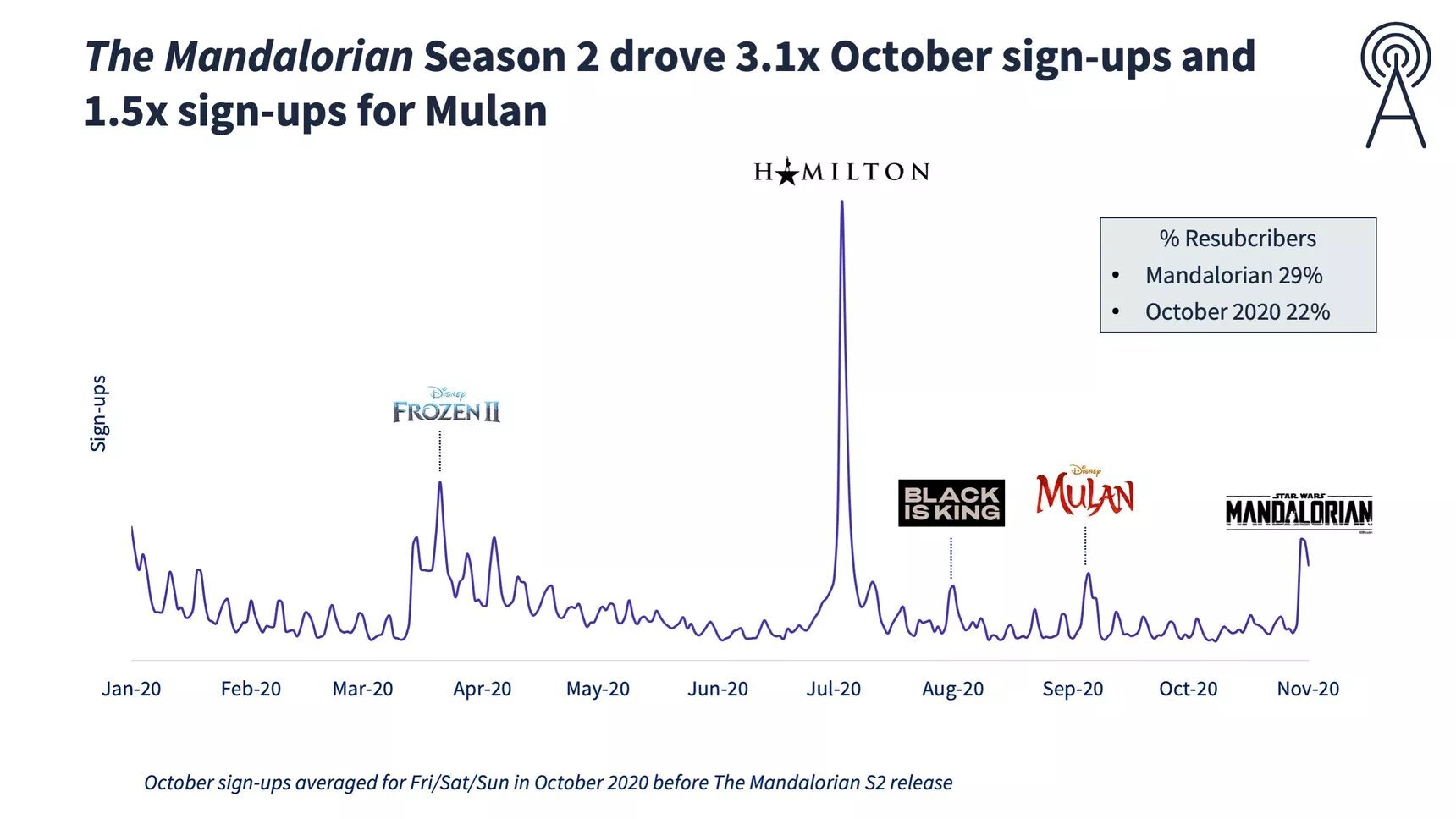

Disney+ is positioned differently than Netflix. I like to describe it as "Netflix for Families”. What's most impressive about the launch is the lack of original content. Disney doesn't have a plethora of content for Disney+. It's only notable show is the Mandalorian. There is also a series of one-off exclusive content that has driven growth such as Hamilton and Mulan.

(Photo Credit: Antenna)

The launch of Mulan, a live-action adaptation of the 1998 movie, is a barometer for the success of DTC. Due to COVID, movie theatre revenue has sharply declined. Disney could leverage Disney+ to skip theatres and release it straight to consumers. Even better, it would keep 100% of the revenue it would earn.

Disney charged $29.99 to watch (in addition to the monthly subscription fee). It's unclear how Mulan performed. Some reports indicate revenue upward of $250MM while other data suggests numbers in the $60MM - $90MM range.

Honestly, who cares? Even if Disney+ made $60M (revenue estimate 11 days after release), it doesn't tell the whole story. It doesn't give insight to the millions of new subscribers Disney+ earned. Ultimately, resulting in millions of dollars in additional revenue for the company.

And this is the point, isn't it? Disney's strategy isn't a one-off, but holistic. Every movie release isn't just one-off revenue from a movie sale, but represented by billions of dollars in recurring revenue. Even if Disney lost money on Mulan initially, it gives them more data. This helps to figure out the content people watch and how to optimize it for maximum revenue. Last week, I wrote about how Netflix's algorithm saved it $1B a year:

"Netflix has spent millions if not billions on their recommendation algorithm. 80% of watched content is based on recommended content. Netflix's former chief product officer wrote in a 2016 paper that the algorithm saves Netflix over $1B a year. Netflix only has 90 seconds to suggest content to a user before it leaves—underlying the importance of the algorithm."

Disney's CEO, Bob Chapek, in their Q4 earnings call didn't share specific data, but announced they were "pleased with the results".

What Disney+'s Success Means?

It's very rare for a behemoth like Disney not only to reinvent itself, but succeed in the way they have. Even more impressive is in the time frame in which they've done it. Disney+'s success has surpassed even the most optimistic expectations of any analyst.

Disney has spent 50+ years building some of the most iconic brands in the world. Brands such as Mickey Mouse and Snow White. It then leveraged those brands to create diversified revenue streams: merchandise, amusement parks and more.

Somewhere along the way, they got lost. Bob Iger was their guiding light and Bob Chapek drove the car that got them there.

Disney's revitalization is a lesson to all. It's not only about content, but what you do with that content. Can you distribute it? Can you monetize the IP? Ultimately, how do you create the best content that makes the most money?

I am excited for the future of Disney. I continue to remain a shareholder. It's new direct to consumer strategy is exactly what Walt Disney would have wanted: using content to fuel the flywheel.